Freelancers who are responsible for VAT or have dealings with the government will be required by the new e-invoicing law. Freelancers who are not responsible for these two segments will have the option to use the system as voluntary users.

Electronic invoicing is a complex topic, and e-Invoices Online has a solution that will make the transition to e-invoices for freelancers fast and simple. This article will provide information on the solution for freelancers who need to be legally compliant and start using electronic invoices.

Electronic Invoice Freelancers: Questions and Answers!

Electronic invoicing has been gradually implemented in Serbia, starting with B2G transactions this year and ending on July 1, 2022. By January 1, 2023, the need for electronic invoices will eventually be extended to all B2B transactions, including those involving public entities and government agencies. E-invoices will be mandatory for all business operators in Serbia, including those operating abroad who are registered with a local fiscal representative.

The platform known as e-invoice has been created to facilitate the exchange of e-invoices and is already operational for B2G invoices sent and received. E-invoices are sent, received, recorded, processed, and stored through the platform.

The primary function of the system is to progressively digitize the economy, which includes issuing, sending, receiving, and storing electronic e-invoices between the private and public sectors, as well as within them. The main users are identified as follows:

-

Public sector entities - general level of state and public enterprises,

-

Private sector entities - all companies and legal entities participating in the VAT system and not part of the public sector, and

-

Voluntary users - all self-employed individuals (employers and companies) who do not belong to either the public or private sectors but have registered to use the system.

This list clearly shows that private sector organizations not part of the VAT system, such as freelancers, are not automatically responsible for the electronic invoice system.

However, freelancers who sell their goods and services to the public sector belong to the group that needs to register in the electronic invoice system. Even though they are not responsible for VAT and therefore do not belong to the public sector, freelancers are required to use SEF as voluntary users to be able to invoice the services provided and goods delivered to the public sector. Without registration in the electronic invoice system, public sector entities cannot settle their obligations related to commercial transactions.

Freelancers who do not deal with the public sector have neither the need nor the obligation to register in the e-invoice system to send and receive invoices through this system. If freelancers register in this system, they become voluntary users of the SEF electronic invoice system , and the same rules apply to them as to other taxpayers:

-

From May 1, 2022, issue invoices to public sector entities.

-

From July 1, 2022, receive all electronic invoices sent through SEF, as well as

-

From January 1, 2023, issue invoices to customers in electronic form.

If you find out that you are required to send and receive electronic invoices, you can always choose one of the following work options to suit your needs:

-

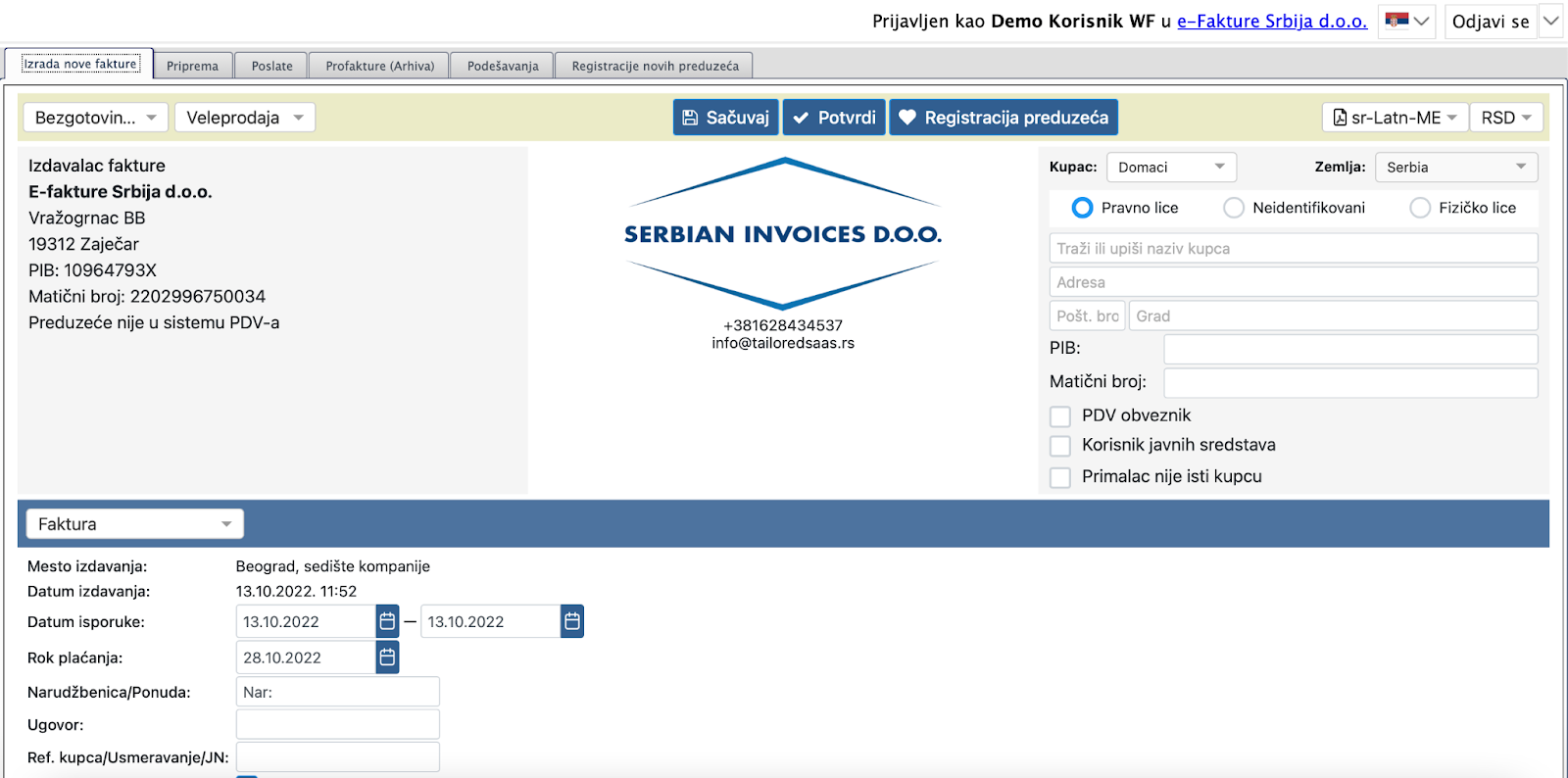

To manually enter invoices through the tax administration portal e-invoice

-

Or use the services of companies that have developed programs with excellent solutions, such as e-invoices.online

Your organization's needs, scope, and complexity will determine the working method you use. Through e-invoices.online services, registration and login to SEF is quick and easy. The additional options we offer are as follows:

-

Inside the program, you can establish a connection to the electronic invoice system (SEF) based on data obtained from the Tax Administration's website (API key).

-

Direct and automatic sending of invoices from the program to SEF.

-

Automatic retrieval of invoices from SEF.

-

Access to your electronic invoice from anywhere and on any device.

-

Compliance of e-invoices with all interstate and EU regulations.

-

Intuitive e-invoice creation.

Learn more about the capabilities of the e-invoice program.

Several of our clients who are freelancers have decided to switch to e-invoices because they have many additional benefits for managing invoices.

e-Invoices for Freelancers - Additional Benefits

-

E-invoices eliminate 60-80% of invoicing process-related costs, resulting in lower costs and higher returns on investment.

-

Increased compliance and more efficient processes: Ensure more transparent and efficient invoice processing to better comply with legal regulations.

-

Greater security: All order transfers are done securely using encryption.

-

More stable cash flow: Immediate distribution of invoices shortens payment processing time, increasing cash flow.

-

Full transparency and faster accounting: Predefined automated access for processing incoming invoices, based on workflow, ensures complete transparency and faster accounting.

-

Compliance with legal requirements: Easier compliance with legal requirements for B2B and B2G e-invoices if necessary.

The Best e-Invoice Program for Freelancers in Serbia

We have a solution for all types of businesses and professionals who want to transition from traditional invoicing to e-invoicing. Whether you are a self-employed individual, transitioning from spreadsheets or more complex documents, or have a well-established system that you want to switch to electronic invoicing, this is the right solution for you. Check out our integration options for existing ERP solutions.

FREE (use of the program is free)

Best for (Freelancers in need of electronic invoices).

-

Without registration, users can test the e-invoice program demo for free.

-

Up to 5 e-invoices per month for FREE

-

Personalization

-

Auto-completion

-

Download e-invoices (.xml & .pdf)

-

Send by email directly from our service

-

Send to the state SEF portal

-

Receive 20 e-invoices

Traditional invoices have been around for some time. However, their use is fraught with issues such as manual data entry, the potential for errors, the inability to adequately track implementation, and excessive paper consumption.

With many benefits and anticipated drawbacks in the early stages of their introduction, e-invoices represent a completely new way of doing business. In conclusion, we can say that electronic invoices are undeniably a step forward in business that will enable all organizations to elevate their operations to a higher level, with a perspective of constant control and stability at all stages of operations.

Frequently Asked Questions about e-Invoices for Freelancers

-

Do I have to register for the e-invoice system as a freelancer?

-

I registered on SEF as a freelancer. What can I do now?

-

Do I have to issue invoices in electronic form from January 1, 2023?

Freelancers who do not deal with the public sector and do not participate in the VAT system do not have the need or obligation to register in the electronic invoice system.

After registration, freelancers become "Voluntary Users" of SEF, and the same rules apply to them as to other taxpayers. In case you change your mind, unfortunately, you must contact the SEF support center.

For now, we know that freelancers who register must spend 2 years before they can request to delete their registration.

Yes, from January 1, 2023, you will need to issue invoices in electronic form if you are a freelancer registered on SEF or a taxpayer.

For more information, you can visit our website e-invoices.online